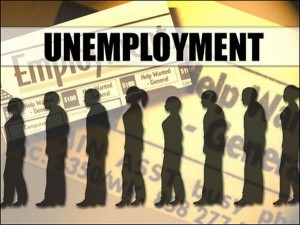

In today’s economic times it’s no secret our economy is in terrible shape. Unemployment is 7.7% food prices are through the roof, and the fiscal cliff is yet to be solved.

Today, more than ever people are uncertain of their future. They’re beginning to realize a college degree just isn’t enough as their force to settle for low paying jobs.

This post was written for those who face these circumstances. It was also written to aid those who seek another way. Below are 6 ways to leverage a recession.

All requires hard work, and all everyone can do.

Focus

With the challenges we face today it is imperative you remain focus. This not only applies to you, it applies to the world around you.

Today more than ever information is exploding with opportunity. This can happen in any asset class whether it’s business, real estate or stocks.

For Instance, on December 5, 2012 Citigroup announce cutting 11,000 jobs. If you understood what this meant, you would of bought calls options when you heard the news.

When a troubled company announces a major layoff its stock often rises. To understand why this happens, you must first understand an investor’s state of mind.

To investors, depending on the situation, a layoff should reduce cost.

Reduce cost sometimes increases revenue so investors buy into the stock.

Of course it is fair to say that stocks do fall under similar circumstances. In this case a sell off may occur if investors thought the company was already well managed.

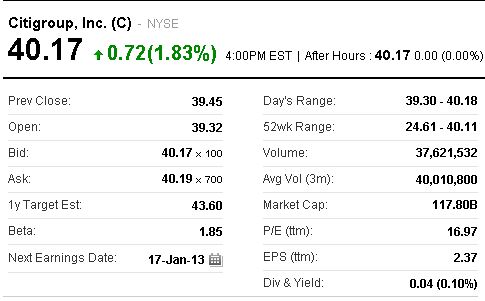

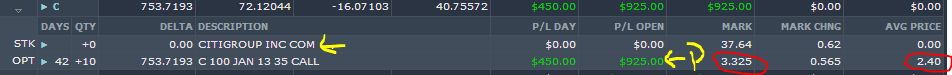

Below are screens shots of Citi groups’ stock movement towards the news.

Screen 1 is the head line which geared traders. Screens 2 and 3 are the market reaction to the headline.

Screen 1 Head line announcement. Time 9:39 am

Screen 2 Stock movements after news. Time 11:22AM

Here you see the stock up 1.64(4.78%) two hours later.

Here you see the stock up 1.64(4.78%) two hours later.

Screen 3 December 20, 2012 two weeks later .Time: 4:00 pm

And here you see the stock breaks its year high (52wk range) closing at $40.17 weeks later

And here you see the stock breaks its year high (52wk range) closing at $40.17 weeks later

I bought call options on Citigroup layoff announcement at $2.40. Profiting, $925

I bought call options on Citigroup layoff announcement at $2.40. Profiting, $925

What’s sad is employees have no idea that this goes on. What even more sad is their C.E.Os just got richer and the employees poorer.

Stock Options

In the stock market there are two markets. One is the stock market, and the other is the options market. On the news you often hear talks of the stock market. That’s because they do little to inform you of the powers of the option market.

To do well in the stock market you must learn to trade both stocks and options.

To do well in investing you must learn to achieve infinite returns.

There are two basic options you need to know if options become your vehicle of choice.

One is a call option that you purchase for an upward movement of a stock. The other is a put option that you purchase for a downward movement of a stock.

A call option gives the owner the right, but not the obligation to buy stock at a specific price called the strike price. The buyer of the option pays a small premium for this right which can be exercise at its strike.

A put option does the opposite but its concept is almost the same.

A put option gives the owner the right, but not the obligation to sell stock at a specific price also called its strike.

Professional traders love puts because of their protection and their abilities to make money in downward markets.

Both options provide extreme leverage potential which is why people use them.

If you want to learn more on how this works I recommend reading “The power of leverage”

If finally options become your vehicles of choice, I recommend buying the Options Boost course.

This course will hold your hand on how to leverage options appropriately.

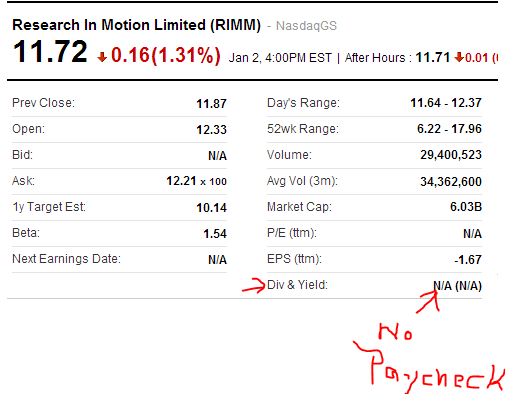

Invest for Income

Whether you’re investing your time or money, investing for income should be your goal.

In stocks, it’s buying dividends stocks.

In Real Estate it’s investing for rent. In business its products and sales, if you’re sophisticated is debt for cash flow.

If you choose stocks it’s important to know not all stocks pay you for ownership.

Since some stocks don’t pay you at all, it’s important that you know the difference.

Below are screens shots to help you identify this clearly.

Gold and Silver

In 1971 president Nixon took us off the gold standard. This meant government could print more dollars than they had in gold.

With governments free to print dollars the clipping of world currencies began. Savers became losers and debtors who invested in cash flowing assets became winners.

Today savers continue to lose money because of the threat of inflation. What’s sad is people continue to save even when interest on savings are paying 0.01%.

If you factor that government’s taxes interest on your savings at ordinary income you’re really being robbed. When money goes into hiding as we’re seeing today, safe assets should be where you store your money.

This is why you’re seeing so many cash for gold commercials. They simply want you’re appreciating assets (jewelry) in exchange for their depreciating assets ( cash) which steals your wealth. The sooner you realize this, the quicker you’ll see there’s something wrong with your money.

If you really want to be ahead, hold on to things that retains value. Jewelry is definitely one, gold and silver coins is also another.

Whatever the case is, protecting value should be your goal.

So the next time you think about buying depreciating objects like a car, ride the uptrend and buy yourself some gold or silver coins.

Start a blog

Today if you want to thrive it is important you learn to leverage yourself.

One of the ways you can do this is to simply start a blog. The reason you see blogs everywhere is because people are leveraging free content.

There are bloggers who make six figures doing this, with the right set-up you can to.

The secret to blogging is simple; it’s content, content, content. I can’t stress this enough because they’re many garbage blogs out there.

The other secret behind blogging is the email list they gradually obtain. This is how some bloggers earned their income they market products to their viewers.

What makes a blog really successful is the content you provide. What makes you successful is the trust your readers surrender to you.

With trust comes sells so don’t market garbage products. Your main focus should be helping people, and blogging is a great way to start.

Build an email list

Aweber

If you want to know what helped bloggers achieved six figures income online, Aweber is it.

Because Aweber is an email marketing software that make building an email list EASY…

With Aweber everything is simple and laid out for you. Not only can you promote and use various templates to help your designs, you can auto pilot your whole business.

Below are features and a short video that will show the power of Aweber. You will see why millions trust them for business and why you should to.

Features:

Get your free PDF aweber-overview.

Try AWeber’s Autoresponders for $1

Hope this article helped you guys.

As always please don’t forget to subscribe.

To your success,

Moneyvehicles.com

Manny

Latest posts by Manny (see all)

- 6 Ways to Leverage a Recession - April 18, 2024

- Who pays the most Taxes? - April 18, 2024

- Financial Literacy Equals Financial Freedom - April 18, 2024

Posted in

Posted in  Tags:

Tags: