Contents

Today many people believe President Obama is the most powerful man in the world. Lacking financial education they think like the norm and fail to understand what true power is.

True power is the ability to affect anything and almost everything around you. It’s the ability to shift lives let alone money changing the direction of wealth for many people.

Although President Obama has great power he is not the most powerful man in the world. So the question remains who is, and why do they have such power?

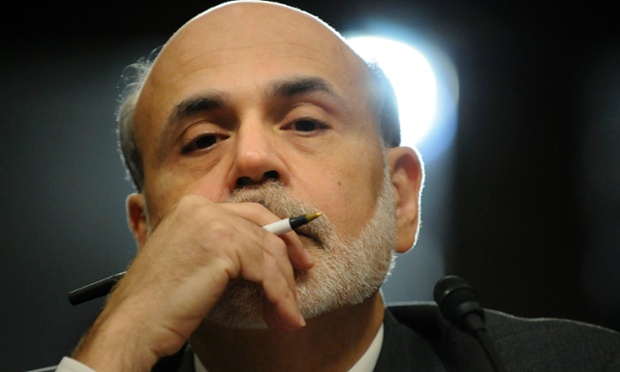

For those of you who didn’t know, Ben Bernanke is the most powerful man in the world.

He is the chairman of the Federal Reserve Bank the world’s largest cartel ever seen to man.

The power of Ben Bernanke affects many lives as you’ll discover in this post. Below are the effects of his power and why you should pay attention to him very closely.

Why is Bernanke so Powerful

The reason Bernanke is so powerful is because he has the ability to print money. Not only can he print money he can change interest rates which eventually alters cash flow.

Bernanke is also very important because he controls the federal funds interest rate. The federal funds interest rate affects 10 year bonds and mortgage rates for many people.

Bernanke’s job is very difficult because he must keep the economy moving at a moderate pace. So depending on the health of the U.S. economy he may take the following actions.

If Bernanke sense growth is slow, he is more likely to lower rates.

However, if he sense inflation is high he more likely to raise rates.

When Bernanke lower interest rates he’s encouraging the public to borrow money. Borrowing money becomes more affordable so it helps speed a recovery.

When Bernanke raise rates this simply means he’s trying to curve inflation. It also mean the economy is moving too fast which can trigger an imbalance in supply and demand.

For instance, if demand exceeds supply, the price of products will go up.

When inflation increases, economic growth begins to slow. The price of the goods also increases which lowers the demand for the product. Less demand leads to less production, and can trigger unemployment.

You can see from these examples how much Bernanke have to overcome, if he makes a mistake it affects you so you better pay attention to him very carefully.

How does this affect you and your family

Because Bernanke can print and control rates he controls the directions of people’s wealth.

When Obama borrowed billions to bail out the auto industry, who do you think had to pay that money back with interest?

If you guessed the American people than you’re already right on track.

The american people pay the interest on the billions borrowed this is one of the reasons why taxes is higher today.

When president Obama borrows money from the Fed he’s actually making your life a little harder.

The same can be said when the fed lower rates those who are savers become the biggest losers.

Those who borrow money to buy assets at low rates become the winners in the end.

To protect you and your family investments, I suggest you watch the fed.

Bernanke and Housing Market

To further illustrate the power of Bernanke I will use a mortgage on a house as an example.

Let’s say you lacked education and finance a house at adjustable rate instead of fixed. Not only is this stupid its suicide because your rates is subject to change.

Now let’s say Bernanke gives a public speech stating he’s raising rates because inflation poses a threat to the economy.

This is bad news for you simply because your mortgage payments can rise dramatically.

Of course if you struggle to pay your mortgage the next stop is foreclosure.

This simple example don’t only affect mortgages it affects rates millions already have.

Bernanke and the Stock Market

Because Bernanke controls the power of money investors listen closely when he speaks. The wrong speech can cause wild swings in the markets as we seen June 19, 2013.

On Thursday June 19, Bernanke announce he’s going to raise rates. Not only was he going to raise rates but he was reducing his bond buying from 85 billion to 40 billion.

The markets didn’t like the news forecast so a sell off was triggered, many didn’t know why.

Well the markets got use to the flooding of dollars reducing its process made a little discomfort.

Another reason a sell-off occurred is because investors feared the rising of rates.

Because Bernanke may raise rates investors feared this can postpone growth.

The Power of speech

Throughout history we’ve known many speeches which in time changed the world.

Today speeches are affecting shorter time frames and affecting the lives of many people.

The power of speech is given to the president and also to people far more powerful than him.

Bernanke is a prime example of this so when he speaks you better listen.

As always please don’t forget to subscribe. Stay tune to the follow-up of this article as I reveal why knowledge is the new money.

To your success

Moneyvvehicles.com

If you liked this please share. Thanks!

Latest posts by James Edwards (see all)

- When is Tilrays Earnings - April 16, 2024

- The Real Reason Stocks is Falling - April 16, 2024

- How to Start a Blog With a Millionaire Mindset - April 16, 2024

Posted in

Posted in  Tags:

Tags: