Finance Made Simple

For most people, the world of finance can be a very confusing subject. Because of this, some simply avoid their finances.

The reason people are in debt today is because they never took control of their cash flow.

If this is you, especially with interest rates at record lows, now is the time to do so.When it comes to money, cash is king.

For instance, if you run a business and cash stops flowing in, then your business goes to the ground.

The key to keeping your finances in order is to treat your finances as if it was a business.

One of the ways to do this is to keep updated financial statement on your self. The reason to do this is to monitor your investments and cash flow. If you have no idea how your money is spent, moving forward can be a difficult task.

Start with the Basics

When evaluating your financials, what you’re looking for is the cash flow pattern of your money. If more cash flows in then total expense, you doing well. If more cash flows out then total income, you’re in trouble.

The point is, no matter what your finances look like, cash flow tells your story.

The following are over simplified examples on how this works, and what you can do to get on track.

Financial Statement

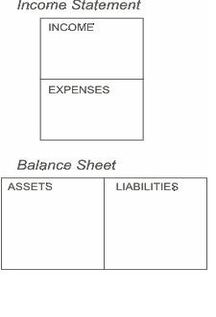

Diagram 1

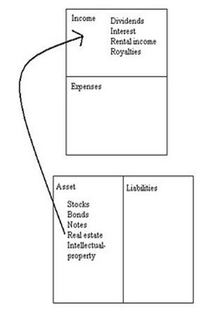

When looking at a financial statement you will notice several things. First, there is an income statement where you list your income and expenses. Then, there is a balance sheet where asset and liabilities is recorded.

When looking at a financial statement you will notice several things. First, there is an income statement where you list your income and expenses. Then, there is a balance sheet where asset and liabilities is recorded.

Assets are important because they put money in your pocket whether you work or not.

Liabilities are also important because they take money from your pocket whether you work or not.

If you stop working today, assets feed you and liabilities eat you. Today as this recession grows people are finding out the hard way their liabilities they thought were assets were not really assets to begin with.

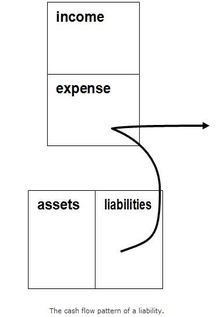

The cash flow pattern for liabilities

Diagram 2

In the above diagram what you are seeing is the cash flow pattern of most people. This is the cash flow pattern of a liability. For most, income flows in, bills are paid and cash flows out the expense column. This is the very reason why people struggle all their lives.

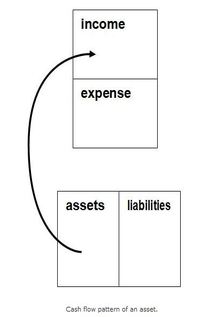

Cash flow pattern for Assets

Diagram 3

Diagram 3 shows a cash flow pattern of a person who continues looking for investments that generates cash flow. These investments are called assets. Money comes in then it’s reinvested into cash flowing vehicles. Bills are still paid, but from investments already made. The difference is these people understand the importance of putting their money to work. They also understand to pay yourself first.

The reason people struggle to get ahead all their lives is because they pay everyone first then pay themselves last.

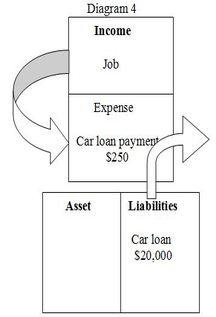

For example, we all seen car commercials of low down financing on expensive vehicles. Often it would say “lease a car for as low as $250 a month” which to most sounds like a great deal. Immediately a person with no emotional control jumps for joy when they see the car of their dreams. Without thinking they assume they could afford it; the problem is, the only income they have is their job.

What the average person doesn’t understand is our system makes it easy to get into debt. Why? Because debt no matter which side your on reverses cash flow.

A low monthly payment doesn’t mean you can afford it. In actuality all it really means is they’re making it easy for you to afford. In the end you have to make the decision does this make sense base on your financials. Unfortunately in these cases most people make the wrong decisions and often find themselves trap in the world of bad debt.

Using the car example here’s what it looks like.

Looking at this statement, you can see $250 exiting out the expense column. There’s also a $20,000 debt which is the obligation of the buyer of the vehicle. Although this isn’t wise, it’s not far fetch from what most people do. New toys, expensive vehicles make it easy to trap people in bad debt, especially words such as low down payments.

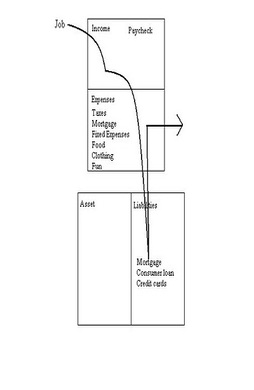

Looking closer

If you want to obtain financial freedom it’s important you take control of your cash flow. To do this first examine your expense column which is where most problems lies.

If you look at the average person’s expenses it’s loaded with draining vehicles.

Diagram 5 illustrates this point, which is the reason why many struggle to get ahead.

Diagram 5

Play to win

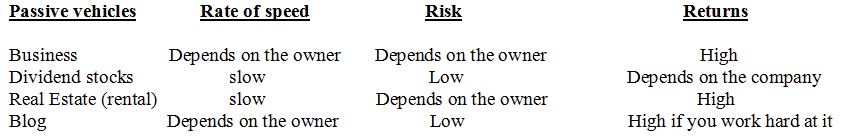

The key to winning the money game is to get your passive income higher than your total monthly expenses.

You can start by paying off your debts, or investing in income generating vehicles.

If this not an option for you then calculate your monthly expenses instead. Remember to factor in food and other expenses to get an estimate that is real. Once you got an estimate of your expense add an extra $1500 in case of emergencies.

For example, if your monthly expense total is $3500 then $5000 in passive income should be your goal.

It is important to add more then needed towards passive income because you never know when life throws you a curve ball.

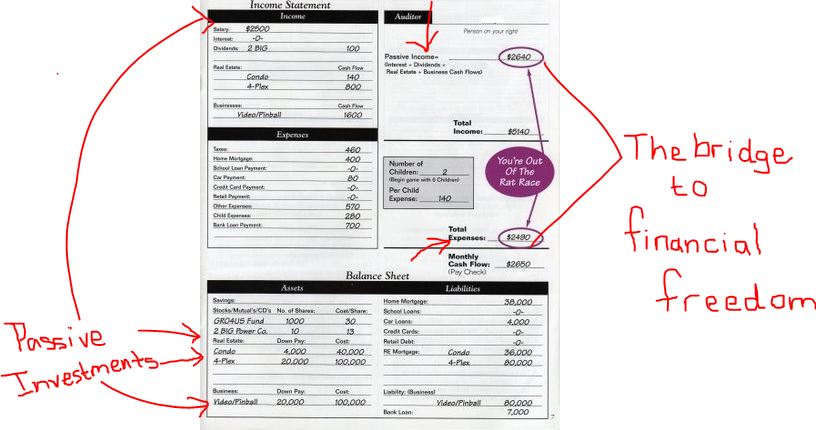

Below is an example of a financial statement from a game me and my friends play called cash flow. The goal is reach financial freedom by investing in vehicles that help you surpass your monthly expenses.

Diagram 6

Focus on assets

Diagram 7

Choose your vehicle

The next step is to choose your passive vehicle of choice. You can have several if you like. What’s important is to have them paying you every month. What’s also important is to have them overlap your total monthly expense. Below is a series of vehicles you can choose from. You could choose others if you like, as long as it gets the job done.

As always please don’t forget to subscribe to Money vehicles for more updates. Hope this helps you towards your journey. Take care.