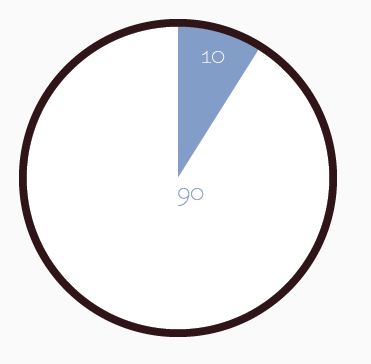

One of the keys to success is solving the 90/10 riddle. If you want to be successful it is imperative that you focus on this riddle. If you never heard of this riddle before, here it is: “How do you fill your asset column without buying an asset”.

For those of you who read my blogs you may recall I wrote an article called “The Best Things Are Free.” If you haven’t read it yet click here. One of the reason why I wrote this article was to introduce the 90/10 riddle of money. You may recall I mentioned a girl by the name of Ashley Qualls who built a website called Whateverlife.com leveraging google adsense programs.

If you understand the 90/10 concept you will begin to realize how Ashley actually solved its riddle.

The interesting thing is Ashley was not the only entrepreneur to do this, there was other people who done this as well.

To name a few you have entrepreneurs like Bill gates of Microsoft soft, Michael Dell of Dell computers, and Mark Zuckerberg of Facebook.

To understand how Ashley and successful entrepreneurs solved this riddle the following factors must become part of your reality.

Factor #1:

Money Is Not Real

To solve the 90/10 riddle you must understand money is not real. Money is whatever you want it to be. For example, if I own something that you want then turn around and sell it to you I just generated money out of thin air. The product you needed I provided, at that point it made me money.

It is no different then a company providing fresh ideas to a niche that starving for new products, and later charges them for the products. This is why the saying rings true when they say “give the market what it wants”.

The most successful people in the world understand this way of thinking. Because of this they make money almost from anything they touch.

The reason we’re seeing more millionaire at such a young age is because their belief of money which been passed from parent to child has changed. Children are starting to break hold on what they been taught about money as they discovery new avenues using the internet.

This is why the power of belief is important which is the reason why you must be cautious with what you let in your mind.

Factor#2

Financial Statement

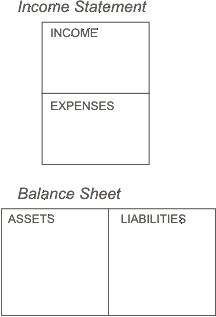

Your financial statement is your report card for life. It plays hand to hand with your credit report, which is another factor which judge you. The cashflow pattern of a financial statement shows if you’re heading towards financial freedom or heading towards the poor house.

Understanding financial statements lets you see a true asset from a draining liability. It gives you power against crooks and cheats who often trick you into bad debt. Another power of your financial statement is it lets you see how your thought patterns is when it comes to managing your money. Later we will review a financial statement with the 90/10 riddle embedded. This is why I wrote “The power of Your Mind” click here.

Factor#3

Asset vs. Liabilities

To keep it simple, assets puts money in your pocket and liability takes money from your pocket. This is important because even if you do solve the 90/10 riddle, it doesn’t guarantee your asset won’t become a liability. You want to learn to think in financial statements to keep an asset remaining an asset. This is also useful because it helps keep your liability from affecting your assets.

Successful people keep a close eye on their assets and liabilities to keep stable control their finances. Their strategy is to keep their assets revenue high and use vehicles to off set their liabilities. The more they reduce their liabilities is the more their net worth becomes.

Factor#4

Creativity, Courage and Fear

The reason most people struggle to solve the 90/10 riddle is because they gave up on their creative skills. The world is too dangerous in their minds so fear overcomes them and creativity jumped out the window. The cost of saying “I can’t or I don’t have a job” can cost you millions.

When you were young you didn’t always think this way because children tend to challenge the impossible because they always have something to prove. Now that you’re older you tend to question everything because you know of its consequences which cause you to be hesitant.

Part of solving the 90/10 riddle involves becoming the fearful child you once were when you were young. This person still exists in most people, the only reason why this isn’t them now is because they tend to think in fear instead with creativity and courage.

Now that we gone through the factors which helps solve the riddle now lets look at it when we view a financial statement reviewing the riddle once again.

90/10 riddle: “How do you fill your asset column without buying an asset”.

All credit to richdad education

All credit to richdad education

The short answer to the riddle is : Create an asset.

Why People Struggle To Solve The 90/10 Riddle

The reason why people struggle to solve this riddle is because their taught all their lives to use money to make money.

Our educational system those an excellent job in this area because they don’t train people how to create money out of thin air.

To become wealthy you must learn to make money with little or no money at all.

Turning nothing into something is the real formula for riches if that’s really the life you want to live.

Brain Exercise

Everyday on you’re spare time look at the asset column on you’re financial statement and ask

yourself how can you fill your asset column with a cash generation asset. If you can do this with little or no money, you come closer by the day on solving the riddle.

The reason the rich is so rich is because money is just an idea in their minds. Everyday they think creatively on filling their asst column and this is why they are rich. All it takes is a little discipline and creativity to make this happen. If you want to solve this riddle, I suggest you do this once or twice a week . While you asking yourself how to do this another question to ask yourself is what problem you see happen repeatedly that has not been solved. That is the key.

As always don’t forget to subscribe to my feed. Hope you enjoyed this article, till next time.

Posted in

Posted in  Tags:

Tags: